The Government's vision is to enhance the modernization and development of domestic trade in order to significantly increase commercial exchanges. Achieving this ambition involves: (i) strengthening the capacity of supply and trade-related infrastructure; (ii) developing national and regional value chains; (iii) formalizing, supporting, and financing traders; and (iv) integrating e-commerce as a force for inclusion.

Thus, the Ivorian Government has initiated an intense and sustainable policy for the modernization of the domestic trade sub-sector through: (a) the construction and rehabilitation of market infrastructure; (b) market surveillance to ensure transparency and fairness in commercial transactions; (c) improving distribution and supply circuits for urban and rural centers; (d) consumer protection; and (e) the regular dissemination of prices for essential consumer goods.

This policy has resulted in:

- the ongoing rehabilitation since 2022 of the Bouaké wholesale market;

- the start in 2023 of the construction of wholesale markets in Abidjan, Daloa, and Abengourou, financed by the World Bank (PD2CV Project);

- the construction of the Abidjan Exhibition Park, with Phase 1 delivered in July 2023;

- the commencement in July 2023 of construction work on a semi-wholesale and retail market in Yopougon, financed by AFD;

- the start in 2022 of the construction of 40 proximity markets (PURGA 2) across the Ivorian territory;

- the digitization of price and stock records starting in 2022;

- the implementation of the project for issuing professional trader cards established since 2018, with approximately 50,000 trader cards distributed out of 59,346 cards issued as of March 31, 2023;

- the fight against fraud and counterfeiting;

- the implementation of measures and actions to combat the high cost of living, including the establishment of 31 local committees to combat the high cost of living in collaboration with professional organizations of traders and consumers since 2021; the expansion in March 2022 of the list of regulated essential consumer goods and services from 4 to 21 categories.

Regulatory Framework

The modernization and development of domestic trade relies on strengthening the institutional and legal framework through the definition, establishment, and operationalization of a robust system targeting key issues in the sector. Practically, the interventions address issues of competition, legal metrology, fraud surveillance and repression, supply and distribution of goods, consumption, quality control, and the fight against the high cost of living.

In this context, several entities have been established, including the Office for the Promotion of Food Products (OCPV) since 1984; the National Council for the Fight Against the High Cost of Living (CNLVC) since 2017; the Competition Commission since 2017; and the National Consumer Council (CNCO) since 2016.

The main legal and regulatory texts related to domestic trade are:

- Ordinance No. 2013-662 of September 20, 2013, relating to competition as amended by Ordinance No. 2019-389 of May 8, 2019. This ordinance governs competition in Côte d'Ivoire, allows for the fight against dominant positions, regulates dumping, etc.;

- Law No. 2016-410 of June 15, 2016, relating to the repression of fraud and counterfeiting in the sale of goods and services. It sets the rules for the repression of fraud and counterfeiting in the sale of goods or services and aims to promote quality control of products and services, particularly foodstuffs;

- Law No. 2016-412 of June 15, 2016, relating to consumption. It governs consumer protection in Côte d'Ivoire and applies to all transactions related to consumption;

- Law No. 2019-989 of November 27, 2019, relating to the National Metrology System in Côte d'Ivoire. It defines the control and evaluation of the conformity of measuring instruments and pre-packaged products as well as the rules for metrological control and traceability concerning reference standards;

- Decree No. 2022-167 of March 9, 2022, setting the list of products and services subject to competition and price regulation, including bakery flour, bread baguettes, beef, pork, and mutton, refined cooking oil, local rice, construction materials, transport tariffs, social housing rents, public water and electricity tariffs, and internet service access tariffs.

- Decree No. 2018-546 of June 6, 2018, defining and organizing promotional events of a commercial, industrial, and artisanal nature in Côte d'Ivoire;

The Distribution System

The distribution system in Côte d'Ivoire includes two main circuits: the traditional market system and the modern large-scale distribution system.

The traditional market system consists of a wholesale market, 58 large markets, 343 temporary retail markets, and 328 permanent retail markets as of the end of 2022.

Large-scale distribution (wholesale and retail of consumer goods) conducted in self-service in a minimum sales area (hypermarket, supermarket, convenience store) is booming in Côte d'Ivoire. The trade sector has recorded an average annual growth of 8.5% from 2015 to 2022 and contributed 15.5% to GDP in 2022. Ivorian large-scale distribution is dominated by five (05) major groups: the Distribution Company of All Goods "Prosuma" (with about twenty brands including Casino, Bon prix, Hyper Hayat, and Fnac), CDCI (with the Leader Price franchise and semi-wholesale stores), CFAO Distribution/Carrefour (with the Carrefour and SupEco brands), Auchan, and MataHolding (with the Citydia brand).

Furthermore, the development of e-commerce has spurred the establishment of groups specializing in the online sale of goods and services, the main ones being Jumia, Yaatoo, Afrimarket, and Librairie de France Groupe. According to a McKinsey & Company study, by 2025, e-commerce could represent 10% of retail sales in the largest African economies, and Côte d'Ivoire is no exception. This dynamic is supported by the growth of online payment systems and significant partnerships between Alibaba and Bolloré (logistics, cloud, innovation), and between Jumia and Vivo Energy (delivery points).

While large-scale distribution is predominantly food-oriented, Ivorian e-commerce is more focused on electronics and home appliances.

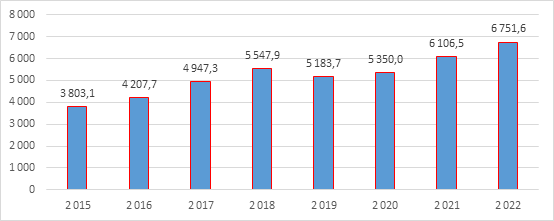

Evolution of the Added Value of the Trade Sector (in billions of FCFA)

Source: National Institute of Statistics; Ministry of Economy and Finance

Documents to Download:

| Designation | Action |

| Law No. 2016-410 of June 15, 2016, relating to the repression of fraud and counterfeiting | law-n-2016-410-of-june-15-2016-relating-to-the-repression-of-fraud-and-counterfeiting.pdf |

| Law No. 2016-411 of June 15, 2016, relating to the national metrology system | law-n-2016-411-of-june-15-2016-relating-to-the-national-metrology-system.pdf |

| Law No. 2016-412 of June 15, 2016, relating to consumption | law-n-2016-412-of-june-15-2016-relating-to-consumption.pdf |

| Ordinance No. 2013-662 of September 20, 2013, relating to competition | ordinance-n-2013-662-of-september-20-2013-relating-to-competition.pdf |

Recent Evolution of Retail Trade Indicators

| Designation | 2017 | 2018 | 2019 | 2020 | 2021 |

| Value Added of Trade (in billions) | 5,071.80 | 5,559.90 | 5,831.00 | 5,821.90 | 6,722.50 |

| Average Revenue Index | 130.6 | 142.2 | 148 | 143.1 | 159.5 |

Sources: INS (National Institute of Statistics); Central Bank of West African States (CBWAS); MEF (Ministry of the Economy and Finance)/(General Management of Economy) DGE, (General Management of Finance - DGF)