Legal and Institutional Framework

Banking activities within the West African Monetary Union (WAMU) are primarily governed by the framework law on banking regulation and its implementing texts.

At the regional level, the Ivorian banking sector is regulated by the Central Bank of West African States (BCEAO). The Banking Commission of WAMU is responsible for its supervision and regulation.

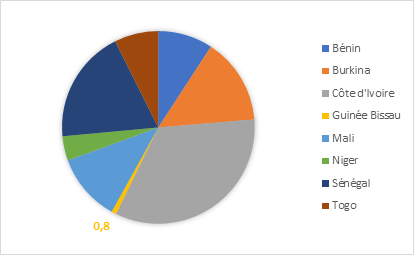

Market Shares of the Banking Sectors in WAMU

Source : Banking Commission of WAMU, 2023

The Ivorian banking system dominates the banking landscape of WAMU as of December 31, 2023. The total balance sheet of credit institutions in Côte d'Ivoire amounts to 22,188.1 billion CFA francs, corresponding to 33.6% of the market share of UEMOA.

National Banking Activity

As of December 31, 2023, the Ivorian banking system comprises 32 licensed credit institutions, including 28 banks (15 international and 13 sub-regional) and 4 financial institutions with banking characteristics (1 international and 3 sub-regional).

In 2022, the number of bank accounts reached 6,331,550 compared to 3,277,292 in 2017.

In terms of concentration, the Ivorian banking sector includes 4 Systemically Important Banks (SIBs) out of the 28 in the member countries of UEMOA in 2022. These SIBs account for 37.7% of the local market share. In the regional market, they represent 12.6% of banking assets, 39.1% of loans, and 38.1% of deposits.

Evolution of Banking Service Penetration

|

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Credit Institutions |

30 |

29 |

29 |

28 |

30 |

31 |

31 |

|

Number of Branches |

709 |

694 |

725 |

736 |

733 |

664 |

847 |

|

Number of ATMs |

1,004 |

713 |

900 |

1,133 |

1,174 |

935 |

|

|

Number of Bank Accounts |

3,277,292 |

3,917,884 |

3,931,729 |

4,599,895 |

5,490,498 |

6,331,550 |

|

Source : BCEAO

Total balance sheet of the banking systems of the UMOA member countries at the end of 2023

|

Country |

Total balance sheet |

Market share (in %) |

|

Benin |

6,418.468 |

9.74 |

|

Burkina Faso |

9,111.367 |

13.81 |

|

Côte d'Ivoire |

22,188.065 |

33.65 |

|

Guinea-Bissau |

452.639 |

0.69 |

|

Mali |

7,567.330 |

11.48 |

|

Niger |

2,511.594 |

3.81 |

|

Senegal |

12,853.095 |

19.50 |

|

Togo |

4,823.441 |

7.3 |

|

UMOA |

65,925.969 |

100 |

Source : Banking Commission of UMOA