Here is the translation of the provided text into English:

- Cleaning up the microfinance sector, with forty-six (46) licensed institutions in 2023, compared to 62 in 2015;

- The cleanup of the microfinance sector has contributed to improving the financial situation, particularly the quality of the loan portfolio and the strengthening of equity;

- However, the recorded dynamism includes:

- four hundred twenty-five (425) service points distributed across the national territory in 2023, compared to three hundred twenty-seven (327) in 2015;

- 2,309,469 members or clients assessed at the end of 2023 compared to 1,009,440 at the end of 2015;

- Increase in activity volume indicators both in terms of collected savings and granted loans;

- Loans primarily directed towards the Commerce and Hospitality sectors. However, financing for the agriculture, transport, and construction sectors has shown good dynamism in recent years.

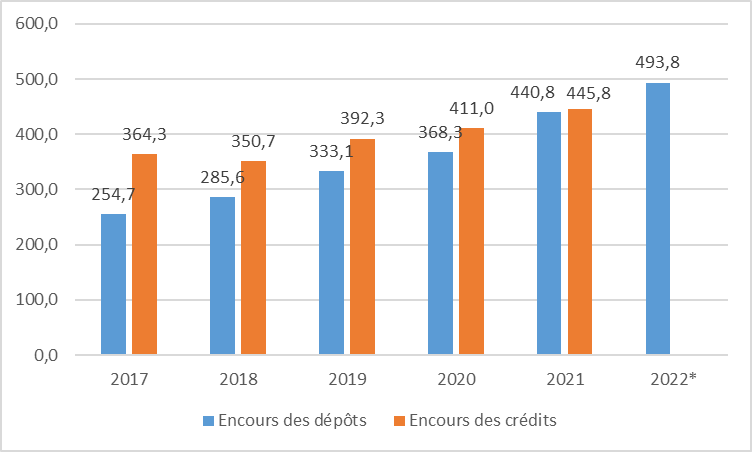

Comparative evolution of deposits and loans (in billions of FCFA)

Source : MFB/DGTCP

Here is the translation of the provided text into English:

Evolution of Collected Savings and Granted Loans

|

Designation |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023* |

|

Outstanding Deposits (in billions of FCFA) |

255 |

286 |

333 |

368 |

438 |

486 |

556 |

|

Men |

131 |

144 |

1,541 |

177 |

216 |

223 |

ND |

|

Women |

64 |

68 |

1,164 |

72 |

96 |

101 |

ND |

|

Legal Entities |

59 |

73 |

5,956 |

119 |

126 |

163 |

ND |

|

Number of Savers (in thousands) |

1,237 |

1,703 |

1,840 |

3,498 |

2,200 |

2,067 |

2,229 |

|

Men |

754 |

1,055 |

1,144 |

2,739 |

1,380 |

1,245 |

ND |

|

Women |

420 |

563 |

599 |

654 |

704 |

696 |

ND |

|

Legal Entities |

62 |

85 |

97 |

106 |

116 |

126 |

ND |

|

Average Savings per Person (in thousands of FCFA) |

206 |

168 |

181 |

112 |

209 |

220 |

249 |

Source : MEF/DGTCP

Evolution of Loans Granted by SFDs

|

Designation |

2017 |

2018 |

2019 |

2020 |

2021 |

2022* |

2023* |

|

Total Amount (in billions FCFA) |

364 |

351 |

392 |

411 |

482 |

565 |

746 |

|

Men |

215 |

194 |

205 |

205 |

236 |

250 |

ND |

|

Women |

96 |

84 |

85 |

80 |

82 |

90 |

ND |

|

Legal Entities |

53 |

73 |

102 |

126 |

164 |

225 |

ND |

|

Total Number of Loans Disbursed (in thousands) |

392 |

407 |

464 |

414 |

414 |

433 |

457 |

|

Men |

258 |

264 |

291 |

277 |

292 |

296 |

ND |

|

Women |

118 |

125 |

153 |

123 |

111 |

118 |

ND |

|

Legal Entities |

15 |

18 |

20 |

136 |

11 |

19 |

ND |

|

Average Loan per Person (in thousands of FCFA) |

930 |

861 |

845 |

993 |

1,166 |

1,304 |

ND |

Source : MEF/DGTCP

Evolution of Sectoral Loans from SFDs (in billions of FCFA)

|

Designation |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023* |

|

Agriculture, Forestry, Fishing |

6 |

13 |

16 |

17 |

22 |

39 |

45 |

67 |

ND |

|

Extractive Industry |

0 |

0 |

0 |

1 |

0 |

1 |

1 |

2 |

ND |

|

Manufacturing Industry |

5 |

6 |

4 |

3 |

6 |

2 |

4 |

6 |

ND |

|

Construction and Public Works |

1 |

1 |

4 |

11 |

18 |

19 |

18 |

23 |

ND |

|

Trade and Hospitality |

104 |

142 |

217 |

188 |

206 |

218 |

254 |

244 |

ND |

|

Electricity, Gas, Water |

0 |

1 |

0 |

2 |

0 |

0 |

1 |

0 |

ND |

|

Transport/Warehousing/Communication |

4 |

8 |

21 |

16 |

12 |

14 |

28 |

27 |

ND |

|

Insurance and Business Services |

1 |

14 |

16 |

7 |

7 |

13 |

16 |

19 |

ND |

|

Real Estate |

7 |

8 |

9 |

10 |

16 |

11 |

12 |

17 |

ND |

|

Diverse Services |

48 |

50 |

77 |

96 |

105 |

94 |

105 |

157 |

ND |

Source : MFB/DGTCP

Evolution of the Number of Clients of SFDs (in millions)

|

Designation |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Total Clients |

1.0 |

1.2 |

1.2 |

1.7 |

1.8 |

2.1 |

2.2 |

2.2 |

2.3 |

|

Men |

0.6 |

0.7 |

0.8 |

1.1 |

1.1 |

1.3 |

1.4 |

1.3 |

1.4 |

|

Women |

0.3 |

0.4 |

0.4 |

0.5 |

0.6 |

0.6 |

0.7 |

0.8 |

0.7 |

|

Legal Entities |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.1 |

0.2 |

0.1 |

Source : MFB/DGTCP

Evolution of Loans According to Their Purposes from SFDs (in billion FCFA)

|

Designation |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Real Estate |

8 |

8 |

11 |

31 |

24 |

37 |

40 |

31 |

ND |

|

Equipment |

55 |

82 |

110 |

98 |

94 |

69 |

112 |

105 |

ND |

|

Consumption |

16 |

17 |

23 |

27 |

29 |

26 |

30 |

40 |

ND |

|

Cash Management |

84 |

120 |

189 |

159 |

161 |

196 |

198 |

239 |

ND |

|

Others |

11 |

14 |

30 |

35 |

85 |

83 |

103 |

149 |

ND |

Source: MFB/DGTCP

Evolution of the Quality of the Loan Portfolio (in billions of FCFA)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022* |

2023 |

|

Outstanding Loans |

198 |

266 |

303 |

361 |

392 |

442 |

513 |

606 |

|

Amount of Non-Performing Loans |

14 |

23 |

41 |

37 |

60 |

54 |

50 |

ND |

|

Gross Portfolio Degradation Rate (%) |

7 |

9 |

14 |

10 |

15 |

- |

10 |

ND |

Source : MFB/DGTCP

Evolution of the Financial Situation of SFDs (in billions of FCFA)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023* |

|

Net Financial Income for the Year |

41 |

51 |

57 |

64 |

64 |

79 |

94 |

ND |

|

Operating Result for the Year |

5 |

4 |

- 10 |

2 |

- 2 |

- 4 |

- 2 |

ND |

|

Equity |

8 |

31 |

32 |

40 |

46 |

48 |

47 |

59 |

|

Total Net Assets |

293 |

381 |

412 |

486 |

573 |

645 |

735 |

853 |

Source: MFB/DGTCP