Here is the translation of the provided text into English:

- The outstanding receivables from customers are continuously increasing, reaching 12,095 billion FCFA in 2023 compared to 11,036.90 billion FCFA at the end of December 2022.

Evolution of the credit portfolio structure

|

Indicators |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Healthy loans (a) |

6,868.9 |

7,561.2 |

8,447.5 |

9,409.0 |

10,759.40 |

11,757.630 |

|

|

Short term |

3,562.7 |

3,713.5 |

4,437.5 |

4,967.9 |

5,182.20 |

5,411.336 |

|

|

Medium term |

2,959.1 |

3,385.2 |

3,520.2 |

3,826.4 |

4,877.70 |

5,637.921 |

|

|

Long term |

202.1 |

284.6 |

305.7 |

389.4 |

429.1 |

443.337 |

|

|

Financing lease credit |

132.1 |

170.8 |

176.4 |

209.8 |

241.7 |

260.131 |

|

|

Factoring |

12.9 |

7.2 |

7.8 |

15.5 |

28.6 |

4.9 |

|

|

Net non-performing loans (b) |

245.8 |

218.8 |

254.8 |

303.9 |

277.5 |

337.37 |

|

|

Total customer loans (c = a + b) |

7,114.7 |

7,779.9 |

8,702.3 |

9,712.9 |

11,036.90 |

12,095.008 |

|

Source: BCEAO

Customer loans are primarily composed of short-term loans, followed by medium-term loans and long-term loans. However, the shares of long-term loans, leasing, and factoring tend to increase over time.

The banking system is solid with good credit portfolio quality, and a significant number of banks comply with solvency standards.

Evolution of credit portfolio quality (in %)

|

Indicators |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Gross portfolio deterioration rate |

9.26 |

8.60 |

8.81 |

8.84 |

7.80 |

7.32 |

|

Net portfolio deterioration rate |

3.45 |

2.81 |

2.93 |

3.13 |

2.50 |

2.8 |

|

Provisioning rate |

64.95 |

69.26 |

68.77 |

66.71 |

69.50 |

63.7 |

Source: BCEAO

The quality of the banking credit portfolio is improving. The management of credit risk is relatively satisfactory. The gross portfolio deterioration rate is decreasing as of the end of December 2023, standing at 7.3%, compared to 7.8% a year earlier. The net portfolio deterioration rate shows a good profile over the period 2018-2023.

Furthermore, the Ivorian banking sector has remained generally solvent. The average "equity to risk-weighted assets" ratio stood at 13.8% at the end of December 2023, above the minimum standard of 11.50%. Only two banks do not comply with the solvency ratio standard. They hold 1.14% of the total balance sheet of the sector, 1.22% of outstanding loans, and 1.74% of collected deposits.

A large proportion of banks in Côte d'Ivoire comply with solvency standards. In 2023, over 90% of banks meet the three main solidity indicators, namely minimum capital requirements, limits on fixed assets and investments, and risk coverage. The four Systemically Important Banks (SIBs) comply with these solvency standards.

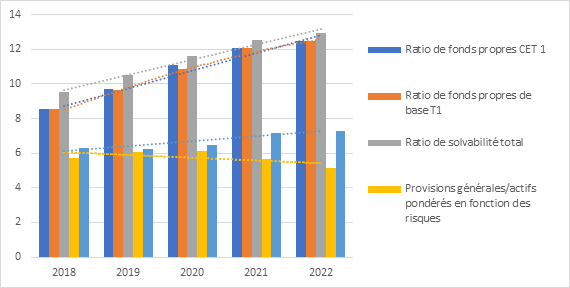

Evolution of solvency indicators

Source: BCEAO

Significantly improved in recent years, the financial strength of banks ensures the stability of the banking sector. In particular, the total solvency ratio stood at 13.8% at the end of 2023 (above the community standard of 11.5%) in relation to the increase in the level of equity to 10 billion FCFA since 2015.

The funding autonomy of the banking sector (Equity/Total assets) is also improving (7.29% in 2022).

Here is the translation of the provided text into English:

Evolution of the Credit Portfolio Structure

|

Indicators |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Healthy Credits (a) |

6,868.9 |

7,561.2 |

8,447.5 |

9,409.0 |

10,759.4 |

11,757.6 |

|

|

Short Term |

3,562.7 |

3,713.5 |

4,437.5 |

4,967.9 |

5,182.2 |

5,411.3 |

|

|

Medium Term |

2,959.1 |

3,385.2 |

3,520.2 |

3,826.4 |

4,877.7 |

5,637.9 |

|

|

Long Term |

202.1 |

284.6 |

305.7 |

389.4 |

429.1 |

443.3 |

|

|

Lease Financing Credit |

132.1 |

170.8 |

176.4 |

209.8 |

241.7 |

260.1 |

|

|

Factoring |

12.9 |

7.2 |

7.8 |

15.5 |

28.6 |

4.9 |

|

|

Net Non-Performing Loans (b) |

245.8 |

218.8 |

254.8 |

303.9 |

277.5 |

337.4 |

|

|

Total Customer Credits (c = a+b) |

7,114.7 |

7,779.9 |

8,702.3 |

9,712.9 |

11,036.9 |

12,095.0 |

|

Source: BCEAO

Proportion of Banks Complying with Solvency Standards

|

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Subject Banks* |

25 |

25 |

27 |

27 |

27 |

26 |

|

Capital Representation (in %) |

96.0 |

96.0 |

85.2 |

92.6 |

92.6 |

92.3 |

|

Limitation of Fixed Assets and Investments (in %) |

100.0 |

100.0 |

92.6 |

92.6 |

92.6 |

92.3 |

|

Risk Coverage (in %) |

72.0 |

80.0 |

85.2 |

88.9 |

92.6 |

92.3 |

|

Capital Adequacy Ratio (T1) (in %) |

72.0 |

84.0 |

85.2 |

88.9 |

92.6 |

92.3 |

|

Common Equity Tier 1 Ratio (CET1) (in %) |

76.0 |

84.0 |

85.2 |

88.9 |

92.6 |

92.3 |

Source : BCEAO

* banks that have been effectively supervised by the Banking Commission, excluding non-banking institutions

Revised Transitional Provisions Regarding Minimum Capital Requirements (in %)

|

Minimum Requirements (including conservation buffer) |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Minimum Ratio for Common Equity Tier 1 (CET 1) |

5.6 |

6.3 |

6.3 |

6.9 |

7.5 |

7.5 |

|

Community Standard |

7.5 |

7.5 |

7.5 |

7.5 |

7.5 |

7.5 |

|

Minimum Tier 1 Capital Ratio |

6.6 |

7.3 |

7.3 |

7.9 |

8.5 |

8.5 |

|

Community Standard |

8.5 |

8.5 |

8.5 |

8.5 |

8.5 |

8.5 |

|

Minimum Solvency Ratio |

8.6 |

9.5 |

9.5 |

10.4 |

11.3 |

11.5 |

|

Community Standard |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

11.5 |

|

Leverage Ratio |

3.0 |

3.0 |

3.0 |

3.0 |

3.0 |

3.0 |

|

Community Standard |

3.0 |

3.0 |

3.0 |

3.0 |

3.0 |

3.0 |

Source: BCEAO

Evolution of Financial Stability Indicators in the Banking Sector (in %)

|

Capital Standards |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

CET 1 Capital Ratio |

8.6 |

9.7 |

11.1 |

12.1 |

12.5 |

13.0 |

|

Tier 1 Capital Ratio |

8.9 |

9.7 |

10.9 |

12.1 |

12.5 |

12.8 |

|

Total Solvency Ratio |

9.6 |

10.5 |

11.6 |

12.6 |

13.0 |

13.6 |

|

General Provisions/Risk-Weighted Assets |

5.7 |

6.1 |

6.2 |

5.7 |

5.2 |

5.9 |

|

Equity/Total Assets |

6.3 |

6.2 |

6.5 |

7.2 |

7.3 |

7.3 |

Source: BCEAO

Outstanding Direct Loans Granted to SMEs (in billions of FCFA)

|

Items |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Customer Credits |

1,479.630 |

1,599.212 |

1,800.281 |

1,876.908 |

|

2,638.471 |

|

Overdraft Accounts |

220.697 |

197.318 |

229.572 |

228.635 |

2,638.471 |

383.855 |

|

Portfolio of Commercial Papers |

54.469 |

60.944 |

115.337 |

127.265 |

|

130.492 |

|

Other Short-Term Credits |

512.413 |

584.860 |

749.097 |

746.218 |

|

1,092.768 |

|

Medium-Term Credits |

387.536 |

467.573 |

359.631 |

338.266 |

|

602.406 |

|

Long-Term Credits |

31.550 |

82.361 |

95.116 |

112.950 |

|

105.579 |

|

Lease Financing Credit |

16.589 |

18.980 |

38.009 |

53.354 |

|

115.146 |

|

Factoring |

7.196 |

0.682 |

0.498 |

0.212 |

|

8.521 |

|

Non-Performing Loans |

249.180 |

186.494 |

213.021 |

270.008 |

|

199.704 |

Source: BCEAO