- Strong growth recorded during the period 2012-2019 (an average of 8.1%);

- Good recovery starting in 2021 after a slowdown in 2020 (0.7%) due to COVID-19;

- Growth primarily driven by final consumption and investment, with respective contributions of 3.5 and 2.3 percentage points in 2023;

- Demand dominated by final consumption, accounting for 78.0% in 2023 and projected to average around 75.9% during the period 2024-2025.

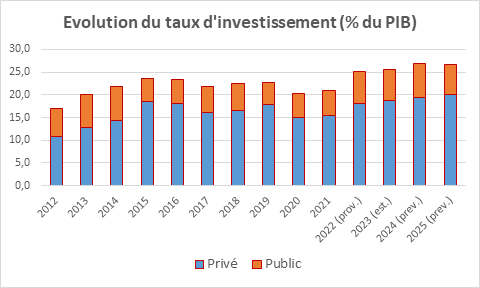

- An investment rate that has been increasing since 2018 (22.5%), reaching 25.5% in 2023 and projected to average 26.7% during the period 2024-2025.

Sources: MEPD/DGE, ANStat

Structure of Demand

The structure of demand in the Ivorian economy is dominated by final consumption, which decreased from 78.4% in 2018 to 78.0% in 2023. However, there is notable dynamism in investments, which increased their share in the economy from 22.5% in 2018 to 25.5% in 2023. During the period 2024-2025, demand is expected to be composed of approximately 75.9% final consumption on average, compared to 26.7% on average for investment.

Evolution of Demand

In 2023, growth was driven by the strengthening of final consumption (+4.5% after +5.3% in 2022) and the consolidation of investments (+9.3% after +13.9% in 2022).

Investments were supported by the initiation and continuation of several projects, including the construction (i) of roads and interchanges as part of the Abidjan urban transport project, (ii) of the Yamoussoukro-Bouaké highway section Tiébissou-Bouaké, (iii) of the bypass highway around the city of Yamoussoukro, (iv) of the Gribo Popoli hydroelectric dam, (v) of the San-Pédro coal power plant, (vi) of the Aboisso biomass power plant, and (vii) of the solar power plants in Boundiali, Laboa, and Touba. Additionally, investments benefited from the strengthening of the road network and production tools in the industrial, mining, and construction sectors.

Thus, the overall investment rate stood at 25.5% of GDP compared to 25.2% in 2022. The public investment rate reached 6.8% in 2023, down from 7.2% in 2022, while the private investment rate rose to 18.7% from 18.0% in 2022.

The increase in final consumption is linked to the strengthening of public consumption (+3.5% after +11.1% in 2022) and household consumption (+4.7% compared to +4.4% in 2022), benefiting from rising incomes and job creation in both the private and public sectors.

In terms of external trade, imports of goods and services increased by 8.4% after a rise of 58.3% in 2022, driven notably by the dynamism of private investments in the extractive sector for the exploitation of various oil fields, including Baleine. Exports of goods and services saw an increase of 2.5% after a rise of 47.9% in 2022, due to strong performance in mining production and processed products.

In 2024, growth is expected to be driven by the dynamism of investments (+14.3% after +9.3% in 2023) and the strengthening of final consumption (+4.4% compared to +4.5% in 2023).

Final consumption would benefit from the continuous increase in household incomes and job creation.

Investments would be supported by the private sector, whose confidence is bolstered by positive economic prospects and an improved business environment. Thus, private investment is expected to grow by 12.3%. Public investment (+19.9%) would also be supported by the initiation and continuation of several projects, including the construction (i) of the Gribo Popoli hydroelectric dam, (ii) of the solar power plants in Boundiali, Laboa, and Touba, (iii) of roads and interchanges as part of the Abidjan urban transport project, and the development and construction of several roads, including (iv) Tabou – Prollo, (v) Blolequin – Toulepleu - Liberia border, (vi) Zuénoula – Daloa, (vii) Zuénoula - Gohitafla – Béoumi, (viii) Séguéla – Toubadu, (ix) Korhogo-Sinématiali – Ferké, (x) Séguéla – Touba, (xi) Tioroniaradougou – Guiembe - Dikodougou, (xii) Korhogo – M’Bengue, and (xiii) Céchi – Anoumanba – M’batto. Furthermore, investments would also benefit from the strengthening of the road network and production tools in the industrial and construction sectors.

The overall investment rate is expected to reach 26.8% of GDP in 2024, compared to 25.5% in 2023. The public investment rate would be set at 7.5% in 2024 after 6.8% in 2023.

In terms of external trade, imports of goods and services are expected to rise by 6.9% after 8.4% in 2023, driven by the dynamism of the economy.

Exports of goods and services would see an increase of 8.8% after 2.5% in 2023, due to strong performance in mining production and processed products.

Real GDP Growth: Demand Perspective (in %)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

def. |

def. |

def. |

def. |

def. |

def. |

prov. |

est. |

prev. |

prev. |

|

|

Final Consumption |

6.2 |

6.4 |

5.9 |

5.8 |

1.4 |

5.4 |

5.3 |

4.5 |

4.4 |

4.7 |

|

Investment |

9.3 |

1.2 |

6.9 |

11.4 |

3.8 |

14.9 |

13.9 |

9.3 |

14.3 |

7.8 |

|

Exports |

-2.2 |

22.0 |

-13.1 |

6.5 |

-1.3 |

16.6 |

46.6 |

3.0 |

7.7 |

7.6 |

|

Imports |

-3.7 |

3.0 |

5.6 |

6.3 |

14.5 |

16.2 |

58.8 |

8.3 |

7.9 |

6.6 |

|

Real GDP |

7.2 |

7.4 |

4.8 |

6.7 |

0.7 |

7.1 |

6.2 |

6.5 |

7.2 |

7.0 |

Sources: MEPD/DGE, ANStat

Contributions of Demand to Real GDP Growth (in %)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

def. |

def. |

def. |

def. |

def. |

def. |

prov. |

est. |

prev. |

prev. |

|

|

Final Consumption |

4.6 |

4.8 |

4.5 |

4.3 |

1.1 |

4.2 |

4.1 |

3.5 |

3.4 |

3.6 |

|

Gross Fixed Capital Formation (GFCF) |

2.2 |

0.3 |

1.5 |

1.6 |

0.8 |

3.0 |

2.9 |

2.3 |

3.7 |

2.1 |

|

Net External Demand |

-0.2 |

2.9 |

-2.0 |

1.3 |

-2.3 |

0.2 |

-2.6 |

-1.8 |

0.2 |

0.3 |

|

TOTAL GDP |

7.2 |

7.4 |

4.8 |

6.7 |

0.7 |

7.1 |

6.2 |

6.5 |

7.2 |

7.0 |

Sources: MEPD/DGE, ANStat

Evolution of Nominal GDP - Demand Perspective (in billions of CFA francs)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

def. |

def. |

def. |

def. |

def. |

def. |

prov. |

est. |

prev. |

prev. |

|

|

Final Consumption |

21,368.0 |

23,432.0 |

25,483.6 |

27,365.5 |

28,374.0 |

31,060.8 |

34,152.5 |

37,266.4 |

40,203.8 |

43,075.6 |

|

Gross Fixed Capital Formation (GFCF) |

6,683.0 |

6,681.0 |

7,303.0 |

7,845.9 |

7,380.7 |

8,500.1 |

11,027.0 |

12,173.7 |

14,057.9 |

15,303.7 |

|

Change in Stock |

-29.3 |

-333.4 |

-69.5 |

-66.1 |

507.2 |

1,016.5 |

508.0 |

141.0 |

-653.1 |

-952.9 |

|

Net External Demand |

665.0 |

712.0 |

-211.0 |

233.7 |

16.1 |

-210.5 |

-1,916.3 |

-1,790.2 |

-1,217.3 |

-39.2 |

|

Nominal GDP |

28,686.7 |

30,491.6 |

32,506.1 |

35,382.0 |

36,278.0 |

40,366.9 |

43,771.2 |

47,790.9 |

52,391.3 |

57,387.2 |

Sources: MEPD/DGE, ANStat

Evolution of the Investment Rate (in %)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

def. |

def. |

def. |

def. |

def. |

def. |

prov. |

est. |

prev. |

prev. |

|

|

Private |

18.0 |

16.2 |

16.5 |

17.3 |

14.9 |

15.4 |

18.0 |

18.7 |

19.3 |

20.0 |

|

Public |

5.3 |

5.7 |

5.9 |

4.9 |

5.4 |

5.7 |

7.2 |

6.8 |

7.5 |

6.7 |

|

Total |

23.3 |

21.9 |

22.5 |

22.2 |

20.3 |

21.1 |

25.2 |

25.5 |

26.8 |

26.7 |

Sources: MEPD/DGE, ANStat