Good performance in mobilizing total revenues and donations, particularly tax revenues

Evolution of total revenues and donations (in billions of FCFA)

|

Designation |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 (prov.) |

2023 (est.) |

2024 (prev.) |

2025 (prev.) |

|||||||||

|

REVENUES AND DONATIONS |

4137.7 |

4523.4 |

4764.1 |

5158.4 |

5289.2 |

6140.2 |

6684.4 |

7771.7 |

8775.9 |

10046.7 |

|||||||||

|

Tax revenues |

3352.6 |

3660.8 |

3882.4 |

4205.4 |

4356.1 |

5096.0 |

5616.7 |

6508.0 |

7533.8 |

8750.0 |

|||||||||

|

Non-tax revenues |

531.6 |

596.5 |

635.6 |

678.1 |

739.9 |

859.6 |

834.0 |

946.9 |

987.2 |

1065.9 |

|||||||||

|

Donations |

253.5 |

266.1 |

246.2 |

274.9 |

193.3 |

184.6 |

233.7 |

316.8 |

254.9 |

230.8 |

|||||||||

Sources : MEPD, MFB

The Government has achieved strong performance in revenue collection. Revenues in 2023 are estimated at 7,454.9 billion FCFA, more than double the level of 3,634.6 billion recorded in 2015. This performance is the result of significant reforms in administration and fiscal policy that have been implemented. These include the segmentation of taxpayers into large, medium, and small enterprises, the digitalization and modernization of the tax administration, the broadening of the tax base, and the rationalization of exemptions.

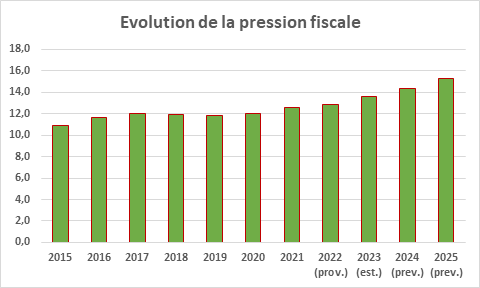

The tax pressure is projected to be 14.4% of GDP in 2024 and 15.2% in 2015, after 13.6% in 2023 and 12.8% in 2022. These levels remain relatively low compared to the UEMOA community standard of a minimum of 20% of GDP.

Sources: MEPD, MFB

In 2021, the level of collection of total revenues and donations amounted to 6,140.2 billion (15.2% of GDP) in connection with efforts to mobilize tax and non-tax revenues.

At the level of domestic taxation, domestic tax revenues amounted to 2,647.3 billion (6.6% of GDP). At the level of border taxation, customs revenues reached 2,239.7 billion (5.5% of GDP). This dynamism stems from the good performance of import duties and taxes, which amounted to 1,721.9 billion.

Non-tax revenues were collected at 859.6 billion. This evolution is mainly due to social security contributions (+67.3 billion) related to the dynamism of the enrollment of self-employed workers and other social security revenues (+52.4 billion).

The level of mobilization of donations is low compared to the target set for the end of December 2021. Out of 212.2 billion in expected donations, 184.6 billion were granted, resulting in a gap of 27.6 billion mainly due to lower-than-expected disbursement of project donations.

In 2022, total revenues and donations (including equalization and exemptions) amounted to 6,684.4 billion (15.3% of GDP).

Tax revenues (including equalization and exemptions) amounted to 5,616.7 billion against an initial forecast of 6,327.0 billion. This shortfall in revenue results from the loss of revenue induced by the Government's efforts to contain the effects of the shocks from the Covid-19 pandemic and the war in Ukraine on the national economy. The tax pressure was established at 12.8%.

Non-tax revenues at the end of 2022 amounted to 834.0 billion, almost in line with the objectives. They consist of 645.5 billion in contributions from social security funds and 188.5 billion in other non-tax revenues.

Project and program donations amounted to 233.7 billion.

In 2023, public finances benefited from a favorable environment and fiscal and budgetary reforms taken to ensure the proper execution of the PND 2021-2025. These reforms focused on optimizing revenue collection and rationalizing tax exemptions.

Total revenues and donations amounted to 7,771.2 billion in 2023. These resources are dominated by tax revenues, which reached 6,507.5 billion in 2023 with a tax pressure of 13.6%.

Non-tax revenues amounted to 946.9 billion, linked to the increase in social contributions induced by the social security reform.

As for donations, they were mobilized at 316.8 billion in 2023 thanks to a substantial increase in project donations, which rose from 39.9 billion in 2022 to 117.1 billion in 2023.

In 2024, total revenues and donations are expected to reach 8,775.9 billion, an increase of 12.9% compared to 2023.